VA Home Loans: Secure Your Desire Home with No Exclusive Home Loan Insurance Coverage

VA Home Loans: Secure Your Desire Home with No Exclusive Home Loan Insurance Coverage

Blog Article

Understanding How Home Loans Can Promote Your Journey Towards Homeownership and Financial Security

Browsing the complexities of home finances is necessary for any person aspiring to accomplish homeownership and develop financial stability. As we think about these critical elements, it ends up being clear that the course to homeownership is not simply about protecting a loan-- it's regarding making educated options that can form your economic future.

Kinds Of Home Loans

Standard financings are a preferred choice, usually requiring a higher credit rating score and a down payment of 5% to 20%. These car loans are not insured by the federal government, which can cause stricter qualification criteria. FHA loans, backed by the Federal Real Estate Management, are developed for novice property buyers and those with lower credit report, allowing for down payments as low as 3.5%.

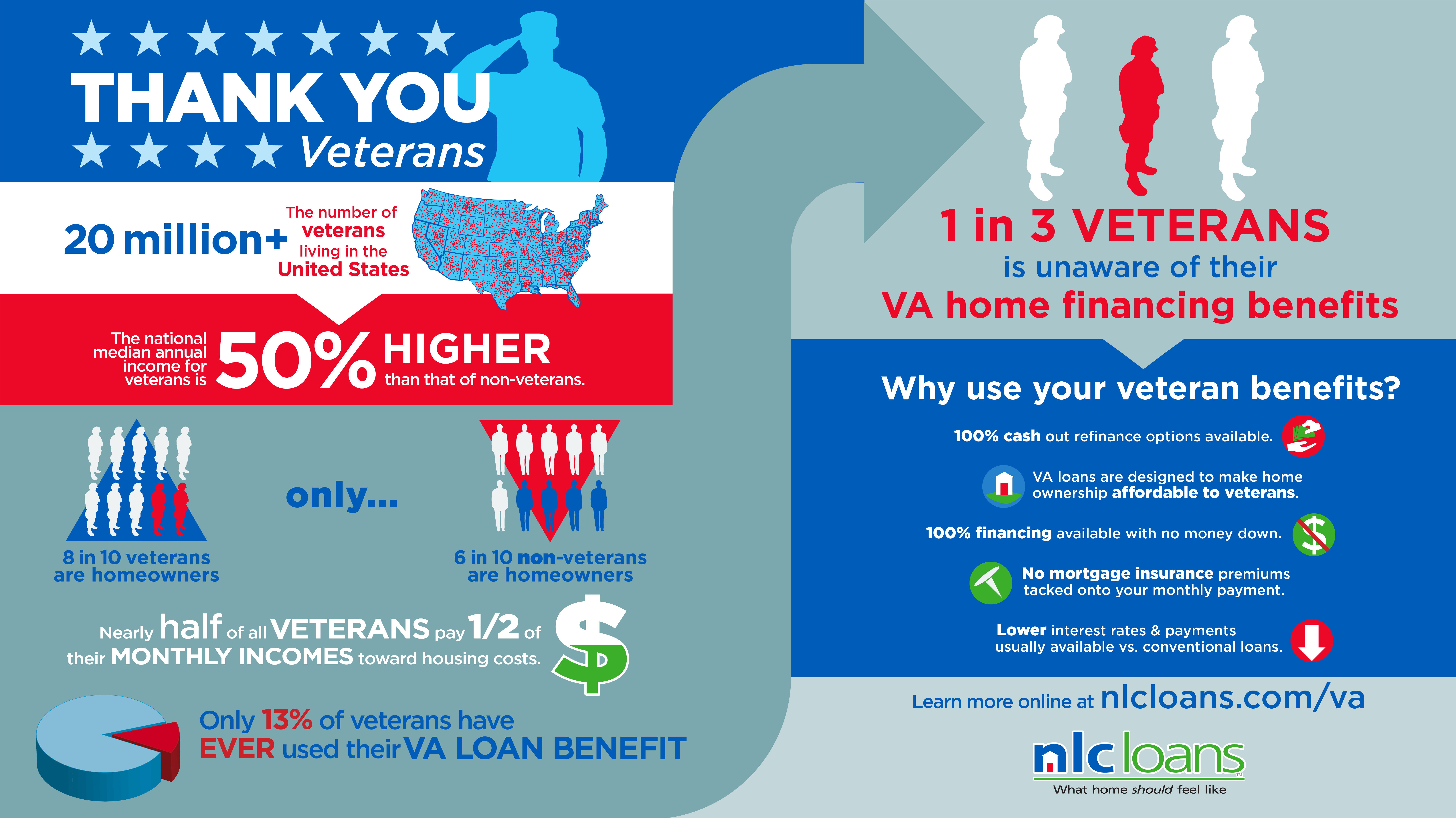

VA car loans, offered to veterans and active-duty army employees, use beneficial terms such as no deposit and no exclusive mortgage insurance coverage (PMI) USDA car loans satisfy country property buyers, promoting homeownership in much less largely populated locations with low-to-moderate earnings levels, additionally needing no down payment.

Last but not least, adjustable-rate home mortgages (ARMs) use reduced initial prices that adjust with time based on market problems, while fixed-rate mortgages give steady monthly repayments. Recognizing these options allows possible property owners to make educated choices, aligning their monetary objectives with one of the most suitable financing type.

Comprehending Rate Of Interest

Rate of interest prices play a pivotal function in the home loan process, substantially influencing the total cost of borrowing. They are essentially the expense of obtaining cash, revealed as a percentage of the loan amount. A reduced rate of interest can lead to significant financial savings over the life of the lending, while a greater rate can lead to raised month-to-month repayments and complete interest paid.

Interest prices change based on various variables, including economic problems, inflation prices, and the monetary plans of central financial institutions. A fixed price stays constant throughout the financing term, supplying predictability in monthly settlements.

Understanding just how rate of interest work is critical for prospective home owners, as they directly affect affordability and monetary planning. It is a good idea to compare rates from various lenders, as also a slight distinction can have a significant effect on the complete expense of the loan. By following market fads, customers can make enlightened decisions that line up with their economic goals.

The Application Refine

Browsing the home mortgage application process can at first seem complicated, yet understanding its essential elements can streamline the trip. The very first step involves gathering necessary documentation, including proof of income, income tax return, and a list of responsibilities and properties. Lenders need this details to review your economic security and credit reliability.

Following, you'll require to pick a lender that aligns with your financial demands. Study numerous home loan products and rates of interest, as these can considerably affect your regular monthly payments. Once you select a lender, you will certainly finish a formal application, which may be done online or face to face.

As soon as your application is approved, the loan provider will release a funding estimate, outlining the prices and terms connected with the home loan. This essential paper permits you to evaluate your choices and make informed choices. Successfully browsing this application process lays a strong foundation for your journey towards homeownership and economic stability.

Managing Your Mortgage

Managing your home mortgage effectively is vital for preserving monetary wellness and guaranteeing long-lasting homeownership success. A positive strategy to home mortgage monitoring entails understanding the terms of your finance, consisting of rate of interest, settlement timetables, and any kind of possible costs. Regularly reviewing your mortgage statements can help you remain educated concerning your staying equilibrium and repayment history.

Creating a budget that suits your home mortgage repayments is important. Make sure that your regular monthly budget includes not just the principal and rate of interest however also residential property tax obligations, property owners insurance, and upkeep prices. This detailed view will certainly protect against monetary strain and unanticipated costs.

This approach can substantially decrease the complete interest paid over the life of the lending and reduce the settlement period. It can lead to lower month-to-month repayments or a more beneficial loan term.

Last but not least, maintaining open interaction with your loan provider can give quality on alternatives available must financial troubles occur. By More hints proactively managing your home loan, you can boost your monetary stability and enhance your course to homeownership.

Long-Term Financial Benefits

Homeownership uses significant long-term monetary advantages that extend beyond simple sanctuary. One of one of the most significant advantages is the capacity for residential property appreciation. With time, genuine estate generally appreciates in value, enabling home owners to construct equity. This equity acts as a financial asset that can be leveraged for future investments or to finance major life events.

Additionally, homeownership provides tax benefits, such as home mortgage interest deductions and real estate tax reductions, which can substantially lower a homeowner's taxed revenue - VA Home Loans. These reductions can cause considerable cost savings, enhancing overall economic security

Moreover, fixed-rate home mortgages secure house owners from rising rental costs, guaranteeing foreseeable month-to-month repayments. This stability permits people to budget plan effectively and strategy for future costs, assisting in long-term financial objectives.

Homeownership also fosters a sense of community and belonging, which can result in enhanced civic interaction and support networks, even more adding to monetary wellness. Ultimately, the financial benefits of homeownership, including equity growth, tax advantages, and cost stability, make it a foundation of long-lasting monetary protection and wealth accumulation for individuals and households navigate here alike.

Final Thought

In final thought, understanding home mortgage is vital for navigating the course to homeownership and accomplishing financial security. By checking out various loan alternatives, comprehending interest prices, and mastering the application procedure, prospective buyers furnish themselves with the knowledge required to make enlightened decisions. In addition, efficient home mortgage administration and recognition of lasting financial advantages contribute dramatically to developing equity and fostering neighborhood engagement. Eventually, informed selections in home financing lead to improved economic safety and overall wellness.

Browsing the complexities of home finances is vital for any person striving to achieve homeownership and establish economic stability. As we take into consideration these crucial components, it becomes clear that the course to homeownership is not simply about protecting a lending-- it's regarding making educated choices that can form your economic future.

Understanding exactly how rate of interest prices function is important for potential home owners, as they straight our website influence affordability and monetary planning.Managing your home loan successfully is crucial for maintaining financial health and guaranteeing long-lasting homeownership success.In final thought, comprehending home financings is crucial for browsing the path to homeownership and achieving financial security.

Report this page